I was pleased to attend an open day at nLighten’s Bristol data centre. It was part of the pan-European ‘edge’ data centre operator’s involvement in Bristol Tech Week. I was especially interested to learn more about the significant investment now being spent on this former Capgemini data centre.

I was pleased to attend an open day at nLighten’s Bristol data centre. It was part of the pan-European ‘edge’ data centre operator’s involvement in Bristol Tech Week. I was especially interested to learn more about the significant investment now being spent on this former Capgemini data centre.

Colo-X has long found the western end of the M4 corridor quite problematic for smaller colocation users. Most of our interest in this region goes to our established partners. These include Cloud Centres, based over the border in South Wales; Indectron in Gloucester, further up the M5; or even back up the M4 to the Reading or M25 market west of London. The investment into nLighten’s Bristol BRS1 site will hopefully lead to a more accessible facility to meet the needs of the local market.

Who are nLighten?

Colo-X first visited this site in January 2023, not long after it had been acquired by Proximity Data Centres. Proximity were then bought by nLighten in September 2023.

nLighten are backed by digital infrastructure investment fund I Squared Capital. The edge-focussed operator now claims 35 sites across Europe, including 10 in the UK. The other 25 nLighten sites are found across Europe. Most are in Germany and France, with others in Spain, Belgium, Switzerland and The Netherlands (also home to nLighten headquarters).

Putting nLighten into context in the UK regional colocation market

All nLighten’s UK data centres (bar the latest addition in Hoddesdon) were originally pulled together by Proximity through a string of acquisitions. The Hoddesdon site was spun out of another I Squared Capital investment EXA Infrastructure (along with six others in Europe). It was added to the UK sites run by nLighten in April 2024. We also learned from the meeting that the small Bridgend, Wales site is now no longer part of nLighten’s UK footprint.

The Colo-X UK Data Centre Database has a total of 23MW of capacity currently available across the nLighten UK estate. But there is scope to almost double this, especially in locations such as Birmingham, Bristol and Swindon.

To put this in context, the Colo-X database has total capacity in the regional retail colocation market (ie outside of London and not including wholesale capacity) of around 100MW. This makes nLighten one of the largest regional colocation providers in the UK.

Other large regional operators include Pulsant and global operator Equinix. Pulsant have around 20MW from nine sites (not including their sites that we classify within the M25, such as Reading or Croydon). And Equinix now have 14MW operating across four data centres in Manchester.

Significant investment into UK data centre estate: more than just a repainted reception!

Tim Anker was really pleased to see the amount of work taking place here to provide a modern, efficient data centre for the Bristol and western end of the M4 motorway.

While the new reception area at nLighten Bristol is impressive, including meeting rooms and client breakout areas, the £15m investment into the data centre's underlying infrastructure is the main area of excitement for us.

Colo-X has had several concerns with the raft of new entrants into the UK retail colocation and edge data centre market over the past few years. One is that while a number of new sites have been brought to market, too many are old and need significant investment to bring up to modern standards. See my report on a visit to the Atlas Edge Leeds data centre back in March 2024 as a great but sadly all-too-rare example of a company who have ‘got it right’ (at least in our view).

Painting the reception and putting a new logo up doesn’t address the underlying issues with the infrastructure that clients rely on – especially efficiency or the PUE measure. This has become particularly apparent over the past few years with significant power cost rises, and a high PUE ratio exacerbating the situation for end users. This has made many of the new sites in the market rather unattractive commercially.

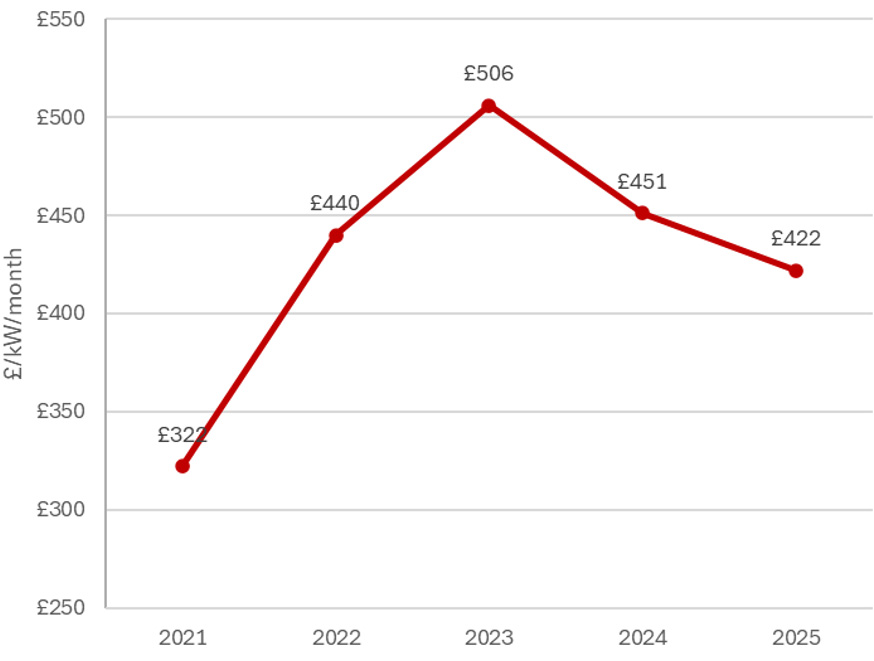

Below: graph showing the trend in average retail colocation costs in the UK over the past five years. (Source Colo-X stats)

Our analysis shows how average retail colocation costs surged from 2021 to a peak in 2023. This coincides with the time that a number of new UK regional data centres were brought to the market. However, we can see that average prices are now beginning to decline. They have dropped by around 20% from the peak, though are still significantly above where they were back in 2021.

It was therefore great to hear that nLighten are now spending £100m on their UK estate, including £15m in Bristol alone. Old UPS and cooling modules are being replaced, and power reorganised into distinct 1.2MW units, with plans to ultimately deliver 9.6MW. New enclosed rack pods are now being installed on the old data floor (with 800mm-wide cabinets we were impressed to see).

The PUE across the new power modules is designed to be in the 1.2–1.3 range. This is a significant improvement on the present situation and much more typical of modern retail colocation facilities in the UK. The result should be a much more competitive offering from nLighten as the benefits of their investment programme are felt.

New nConnect platform moves nLighten towards full-service model smaller users want

We were also interested to hear more about nLighten’s nConnect product: a multi-service port for clients offering a wide range of connectivity options. This is only for when clients want network included as part of their service. nLighten are keen to stress they remain strictly carrier-neutral. Clients can connect to whoever they want, but providing an in-house solution is now an option from nLighten. This fits well with the experience of Colo-X, where we find almost all our clients want a data centre solution that includes power, network and support.

Services offered on the nConnect platform include cloud connect, both internet transit (BGP-based product for users with own IPs) and DIA (where customers use nLighten’s IP addresses) and DC connect, to other nLighten data centres. All of these will add significant flexibility against the existing short carrier list in Bristol of just BT/Openreach and Virgin, so I’m sure it will prove popular. Pricing shared with Colo-X for a typical 100Mbs internet connection was pretty reasonable, though higher-bandwidth users might prefer sites with better network choice for the best deals.

Summary: a much better colocation proposition to come

All in all, it seems that nLighten are taking the right steps both here in Bristol and across their estate. Significant investment is clearly being made to address the problems they’ve inherited by buying data centres that, in most instances, are quite long in the tooth. This should lead to market-competitive efficiencies and customer pricing. Including the nConnect platform will also increase the appeal to smaller end users who typically want an all-inclusive solution.

We usually supply costs and information within 60 minutes during office hours.