I’ve had a lot of calls in the past week about what the combined Equinix/Telecity entity might look like as a proportion of the London colocation market?

So in true Colo-X fashion, here are some quick answers: anything from 17% to 40%! But of course your answer depends on your definitions; or rather, the devil is in the detail!!

Fortunately I’ve just updated my London Colocation Review, a 50 page report on the state of the London retail colocation market, so my capacity estimates which are made up per operator and per site to give market totals are very much up to date (click here for full details of the report).

How much capacity do Telecity and Equinix operate in London?

Our estimate is that at present the combined built out net technical area from the two companies is just under 700,000 sq ft. This figure includes capacity from the following sites:

| Telecity | Equinix |

| Millharbour | London1 – Finsbury Pavement |

| 6&7 Harbour Exchange | London 2 – Heathrow |

| 8&9 Harbour Exchange | London 3 – Park Royal |

| Sovereign House | London 4 – Slough |

| Meridian Gate | London 5 – Slough (pictured) |

| Powergate 1 | London 6 – Slough |

| Powergate 2 |

Then your next question is what is the market overall?

Retail Colocation Only – perhaps 1.6m square feet.

The narrowest definition of the market would be to look at retail colocation facilities only – in other words only including those companies that sell individual cabinets, maybe one at a time, to end users as their MAIN focus. Problem is pretty much everyone will sell a single rack these days, so hard to decide who NOT to include in this narrow definition, but on this basis we would not include the huge amount of capacity in the London market from the likes of DRT (Digital Realty), Global Switch, Infinity and Virtus for example. This gives you a market definition of only 1.6m square feet of net technical capacity, available in both the central London area AND facilities located in the M25 market.

On this narrow definition the combined Telecity/Equinix entity could have as much as 40% of the London carrier neutral retail colocation market.

London Colocation Market including Wholesale – 3.5m square feet

If we add back in wholesale, on the basis that most wholesale operators will now offer single cabinets on the same flexible terms that the retail operators will do, then we add some 900,000 sq feet in the M25 and just over 900,000 sq ft in Central London (eg Global Switch, Level3 Goswell Road) then our base rises to 3.5m sq feet – in which case the combined Equinix/Telecity market share falls to 20%.

The entire UK market – 4 to 4.5m square feet

Finally if we look at the entire UK colocation market, so now including facilities in Manchester, the Midlands or Scotland we add in a further 0.5m to 1m square feet – as ever, deciding what to include or not is becoming increasingly hard to do! But on this basis the 700,000 sq feet of built out capacity from Telecity and Equinix equates to 17.5-15.5% market share.

I think its fair to say these figures are a reasonable guide to the state of the market today. Its probably a bit “old fashioned” to be using square feet as a guide to capacity instead of power, but yet again there are lots of way to measure power – eg gross or customer power, so it is only one way but we feel we can get some reasonably accurate numbers on this basis.

Changing mix of the UK Retail Colocation Marketplace

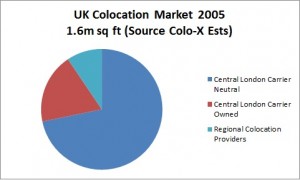

I think the other point to mention (again) is just how much the UK retail colocation market has evolved over the past ten years. If you go back to 2005, ten years ago, the entire UK market was only 1.6m square feet of which 90% was located in central London (in fact mostly London Docklands), as per our chart below:

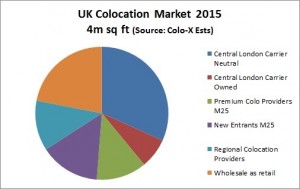

Spring forward 10 years (as below) and we can see that central London capacity is now only some 40% of the entire UK market, primarily due to the massive growth in many forms of capacity (wholesale, new entrant and premium) in the M25 market.

Its perhaps only with perspectives like this that one can see the significant changes that have taken place in the UK and London colocation market over the past few years. Our 2015 review of the London Colocation Market looks at the impact these changes have had and what the consequences might be looking forward.

Please don’t hesitate to contact me to discuss any aspect of this blog post or my report.

Click here for a pdf version of this post.