A guide for retail colocation users seeking data centre options in the north of London, including Herefordshire, Buckinghamshire and Essex.

We have been seeing an increasing number of small-scale data centre enquiries for the north of London market. Smaller companies closing down or consolidating offices are often the driver for this. As a result, clients’ needs are often only for a quarter rack, half rack or one full rack.

The historic focus in the London data centre industry was on the Docklands, Slough, or the west of London corridor. But it seems interest is now switching to other markets, especially where clients want the option of easy access. They are therefore seeking locations that are more convenient than the longer-established London data centre hubs.

While there are number of data centres available north of London, the key is to find the right provider. This will be one who is both interested in small-scale clients and good at servicing them. Fortunately, at Colo-X we have a number of options and plenty of hands-on experience in meeting the needs of this type of client.

Understanding the colocation market in the north of London

First, let’s clarify the two of the main assumptions in this guide:

North of London

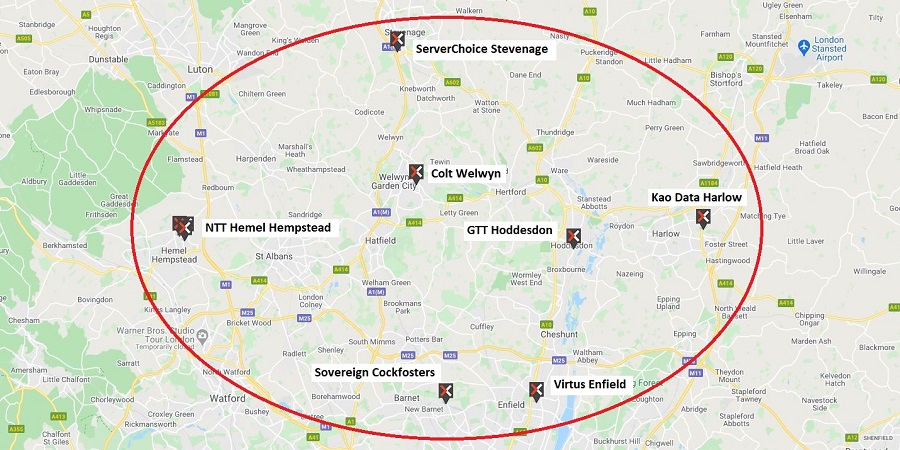

By north of London we are referring to the counties of Buckinghamshire, Hertfordshire and Essex, as well as some North London boroughs such as Enfield and Barnet, just outside of the North Circular orbital road.

Retail colocation

In simple terms the data centre market can be broken down into two types of providers: wholesale and retail. We define retail colocation as including quarter racks, half racks, or rack requirements up to 100kW or 25 racks.

The Colo-X UK Data Centre Database includes nine data centres in the north of London area (out of 132 data centres across the country). We classify six of those nine as wholesale and three as retail. But retail colocation can also be found in wholesale sites, as we explain below.

Wholesale data centres north of London

Wholesale colocation providers are aiming to sell large-scale solutions to large buyers. These days, that usually means at least 1MW and up to 30MW. (1MW is typically 250 racks, so these are very large deals. In fact, this part of the market is now dominated by the hyperscale cloud operators such as Google, Amazon and Microsoft.)

There are now four wholesale focussed operators in the market in the north of London:

We’ve included the facility sizes to give you an idea of the scale of these sites. The Kao Data campus only has one 8MW building up at present, whereas NTT and Colt have the stated capacity available now. NTT have plans for a new 40MW Hemel Hempstead building, which we believe is being taken by a single customer, to be known as HH4.

NTT’s HH3 site in Hemel Hempstead site offers 20MW of capacity but mostly sold to a few very large buyers

NTT

On the face of it these wholesale providers are not suitable for retail colocation buyers… at least not directly. The main exception to this is NTT, who offer racks and cages in dedicated halls. Their HH1 site (originally Gyron Centro) in Hemel Hempstead is now being aimed at smaller users.

Colo-X has placed at least two retail colocation customers with NTT in Hemel over the past year. As the third largest data centre provider in the world (behind Equinix and Digital Realty) NTT seem well suited for larger enterprise customers who don’t need the ecosystem access that both Equinix and Digital Realty are aiming at (for example in Slough or London Docklands).

In our opinion, NTT offer good value, world class facilities, and a highly capable on-site support service. (Note that Dimension Data is now part of the group). Today, their IP backbone is also seen as one of the best in the market. However, other carriers such as Colt or EuNetworks are also available within NTT’s sites.

Colt and Kao Data

Retail colocation in the Colt Welwyn and Kao Data sites is also possible but through Colo-X’s partners. Solutions include quarter, half and full racks, so contact us for pricing if these locations suit you.

Both sites are hugely impressive, with Kao Data now developing a real niche in the life sciences sector (Harlow being the nearest data centre to Cambridge). The Colt Welwyn site, which we last visited in 2019, has seen impressive growth over the past few years. We believe this has been driven by a huge Microsoft deployment.

Virtus

Finally, the Virtus Enfield site is a relatively small wholesale site these days at ‘only’ 8MW but opened in 2011, so now 10 years old. Our understanding is that the site is fully occupied by a mixture of direct customers and resellers. Some of these are Colo-X partners offering retail colocation options in this site, and often benefitting from easy connections back to Docklands (Telehouse/HEX etc).

Retail colocation north of London

Retail colocation providers in the north London area include ServerChoice (in both their own relatively small site in Stevenage, and out of the Kao Data facility in Harlow). Another of our partners, Coreix, use the impressive Colt Welwyn and Virtus Enfield sites.

We’ve placed a number of customers with these two well established Colo-X partners over the past few years. Each offers a variety of quarter, half and full racks, including network and good quality on-site support as part of their data centre package. They are also well suited for dual-site solutions as they already operate out of two locations and network can be easily offered between these sites.

ServerChoice offer retail colocation as quarter, half and individual racks in the Kao Data wholesale campus in Harlow

Coreix and ServerChoice

These are ideal for smaller enterprise clients, or IT-service providers who need a data centre partner for a customer solution. With numerous smaller companies now closing offices and either moving into more flexible accommodation or doing away with offices all together, these high-quality yet small-scale colocation solutions are proving very popular, especially with cost points starting at £250 per month for a quarter rack.

Sovereign Data Connect

Inside the M25 Sovereign Data Connect operate their own 200-rack site in Cockfosters, right at the northern end of the Piccadilly Line and midway between Barnet and Enfield. Similar to ServerChoice and Coreix, Sovereign offer great value, all-inclusive colocation solutions, but do so out of a facility they own and operate.

This gives them scope to offer highly flexible packages. Many IT managers find this attractive as they need time to assess long-term needs and prefer not to be tied into long-term contracts at the outset.

GTT Hoddesdon

Finally, GTT Hoddesdon was originally brought to market by Vtesse. But Vtesse were acquired by Interoute before Interoute bought by GTT in a US$2.3bn deal during the early part of 2018. GTT sold the infrastructure assets of Interoute and Hibernia Networks (a transatlantic submarine-cable operator) to new owners, I Squared Capital in October 2020.

It is therefore hard to know which part of the market GTT Hoddesdon’s site is well suited for. But hopefully this will become clearer once the transaction with I Squared closes. This is expected to happen by the summer of 2021.

As a carrier-owned site, you’d expect GTT Hoddesdon to offer low-cost and low latency back to London Docklands. But the facility may be a little light on power density compared with modern standards due to its age. We’ll await further updates from GTT/I Squared later in the year.

Summary

There are nine data centres in seven locations in the north of London, spread across Buckinghamshire, Hertfordshire and Essex. In fact, there are at least 11 colocation providers across these sites (when companies providing retail solutions in wholesale-focussed facilities are taken into account).

Colo-X has significant experience in working across these facilities and with the various operators available. To engage with us and access our 20 years of experience, simply to get in touch.

Once we understand what a buyer is looking for, we can usually provide pricing right away, and quickly make the right connections to enable formal quotations.

We usually supply costs and information within 60 minutes during office hours.